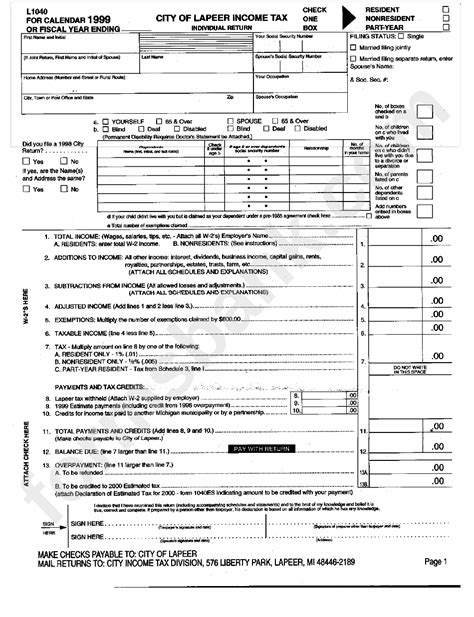

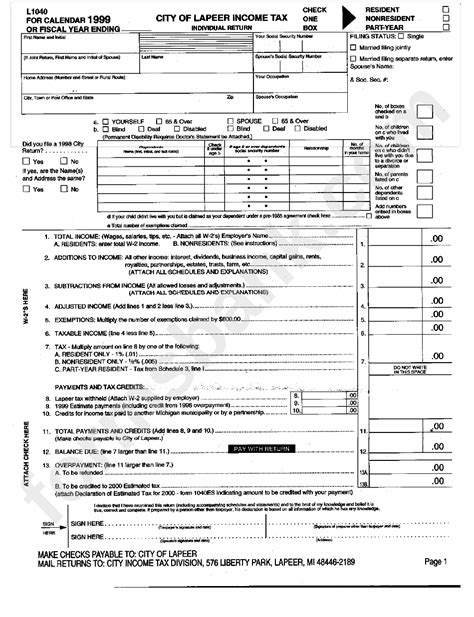

city of lapeer taxes|CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN : Manila Non-Residents must file on income earned in the City of Lapeer.What is the tax rate .

Eastern Time. Eastern Time (ET) is a general term used to describe the areas that observe either the Eastern Standard Time (EST) or Eastern Daylight Time (EDT) in the United States and Canada. ET is not static but switches between EDT and EST. ET is also used somewhat as a de facto official time for all of the United States because it encompasses .

city of lapeer taxes,View the ordinance here: Chapter 23 Income Tax Rates: City Residents: 1% (Individual and Corporate) Non-City Residents who work in the City: 1/2% Taxes Due: City Income Tax returns are due on April 30th of each year or the next business day if it falls on a weekend.LAPEER CITY HALL 576 Liberty Park Lapeer, MI 48446 810-664-2902INCOME TAX FORMS. To verify City of Lapeer addresses: The link below will .

FAST, EASY AND SECURE. There is a nominal fee for the services below. The .

Individuals are able to view tax amounts due, if taxes have been paid, ownership .Non-Residents must file on income earned in the City of Lapeer.What is the tax rate . Summer 2023 Property Taxes are due without penalty and interest on or before July 31, 2023. There is a 4% penalty added on August 1 st and if not paid by .

Step 1: Search Use the search critera below to begin searching for your record. Step 2: Select Record. Step 3: Make Payment. Getting Started. Welcome to the Tax Online .Income Tax Payments and Estimates 1. Gather your information . You’ll need your social security number, street address and birth date or phone number to pay online. 2. .DEDUCTIONS. PAYMENTS AND CREDITS (If line 24 exceeds $100 see instructions for making estimated tax payments) SIGNATURES ARE REQUIRED ON PAGE 2. MAKE .City of Lapeer Income Tax returns are due on or before April 30th or within four months after the end of your fiscal year. Payment Due: Quarterly estimated payments are due .

city of lapeer taxes CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN If you have a question that remains unanswered, please contact us at 810.667.7155. Who is required to file a Lapeer City Individual Income Tax Return? Residents of the city must file on income earned regardless of where earned. Non-Residents must file on income earned in the City of Lapeer. What is the tax rate for the City of Lapeer Income Tax?The city does not receive any of this fee. The payment will appear on your statement as single entry including: The payment itself AND the InSource Solutions Group, Inc. convenience fee. You will be provided a confirmation number once the payment is submitted successfully. Keep this number with your tax records. LAPEER CITY HALL 576 Liberty Park Lapeer, MI 48446 810-664-2902

MAIL RETURN TO: Lapeer City Income Tax Department, 576 Liberty Park, Lapeer, MI 48446. 2022 L-1040 PAGE 1. FAILURE TO ATTACH DOCUMENTATION OR ATTACHING INCORRECT OR INCOMPLETE DOCUMENTATION WILL RESULT IN DEDUCTIONS AND LOSSES BEING DISALLOWED OR DELAY PROCESSING OF RETURN. 27.

New for 2023– File your City Return when using TaxAct Individual Filing Software to file your Federal and State Tax Returns TaxAct – provider of Individual filing software for Federal and State returns is now making efiling to the taxpayers in the city of Lapeer. This is a third party software that Lapeer filers can utilize to file their city return when they file .

You will also be able to pay your property taxes via credit/debit card, you will be leaving the Lapeer Township website and using BS&A and point and pay services to do this. They will charge you a fee to initiate any credit/debit transaction. TAX RECEIPTS. If you need a copy of your tax receipt, please go to BSA by clicking on the link – your .

Go to Income Tax Home Page. If you have a question that remains unanswered, please contact us at 810.667.7155. Who is required to file a Lapeer City Individual Income Tax Return? Residents of the city must file on income earned regardless of where earned. Non-Residents must file on income earned in the City of Lapeer.

LAPEER CITY HALL 576 Liberty Park Lapeer, MI 48446 810-664-2902

Search by Address through Property, Tax, Building Department, Utility Billing, and Business Licensing Records. Name . City of Lapeer, Lapeer County. Please correct the errors and try again. Step 1: Search Use the search critera below to begin searching for your record.Explore Lapeer County Explore someplace new. Center for the Arts. Lapeer District Library. Lapeer Development Corporation. Seven Ponds Nature Center. County of Lapeer. County Complex Building 255 Clay St., Lapeer, MI 48446 Phone Directory; Public Meetings; FOIA; Employment; Board of CommissionersMunicipal Performance Dashboard. The Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens. This data includes a current and prior year overview comparison as well as charts and graphs that allow you to view trends over multiple years. Areas of focus include the following:

A: Residents of the CITY OF LAPEER, Michigan who have income that is subject to taxation need to file Form L-1040. Q: What information do I .

CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN The status of a property on “tax day” determines the following year’s values and taxes. JANUARY 1st week: Annual personal property statements mailed to businesses. FEBRUARY . LAPEER CITY HALL 576 Liberty Park Lapeer, MI 48446 810-664-2902 resources. REAL ID. City Commission.MAIL RETURN TO: Lapeer City Income Tax Department, 576 Liberty Park, Lapeer, MI 48446. 2023 L-1040 PAGE 1. FAILURE TO ATTACH DOCUMENTATION OR ATTACHING INCORRECT OR INCOMPLETE DOCUMENTATION WILL RESULT IN DEDUCTIONS AND LOSSES BEING DISALLOWED OR DELAY PROCESSING OF RETURN. 27.

Income Tax Lapeer City Hall First Floor 576 Liberty Park Lapeer, MI 48446 [email protected] Office Hours: 8:00 a.m. to 5:00 p.m. Monday-Friday City Offices will be closed on City Observed Holidays Phone: 810.667.7155 Fax: 810.667.7157 Laura Dorner Income Tax Clerk [email protected] Municipal Performance Dashboard includes financial and operating measures important to the government and its citizens. This data includes a current and prior year overview comparison as well as charts and graphs that allow you to view trends over multiple years. Areas of focus include the following: BS&A Software provides BS&A Online as a .EMPLOYEE'S WITHHOLDING CERTIFICATE FOR CITY OF LAPEER INCOME TAX ___ NONRESIDENT. 1. Print Full Name. 2. Address, Number and Street. 3. Predominant Place of Employment Print Name of each city where you work for this employer and circle % of total earnings of each. 3. Predominant Place of Employment Print Name of each city .Lapeer Income Tax. Residents of Lapeer pay a flat city income tax of 1.00% on earned income, in addition to the Michigan income tax and the Federal income tax. Nonresidents who work in Lapeer pay a local income tax of 0.50%, which is 0.50% lower than the local income tax paid by residents. Lapeer Income Tax Information:

city of lapeer taxes|CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

PH0 · Welcome to Lapeer, MI

PH1 · The City of Lapeer

PH2 · Online Payment Tax Search

PH3 · Income Tax

PH4 · CITY OF LAPEER INDIVIDUAL INCOME TAX RETURN

PH5 · 2015 City of Lapeer Individual Tax Return L1040